Transforming Macquarie Credit Union’s digital presence with Sitback’s Accelerator Platform

Background

Founded in 1964, Macquarie Credit Union (MCU) is a customer-owned financial institution, where the focus is on members and the community.

In May 2023, MCU embarked on a journey with Sitback, seeking a digital transformation to overhaul their outdated website and align with their newfound commitment to innovation. Led by the newly formed Digital Transformation team, MCU aimed to address significant challenges in their technology infrastructure and enhance their online presence.

Swift and successful digital transformation

💰 Reduced up-front cost through flexible subscription model.

⏱️ Complete re-platform in under 2 months.

📈 Centralised rates management reduced workload and ensures consistency.

🐐”Greatest Of All Time” strategic partnership.

A challenge with a twist

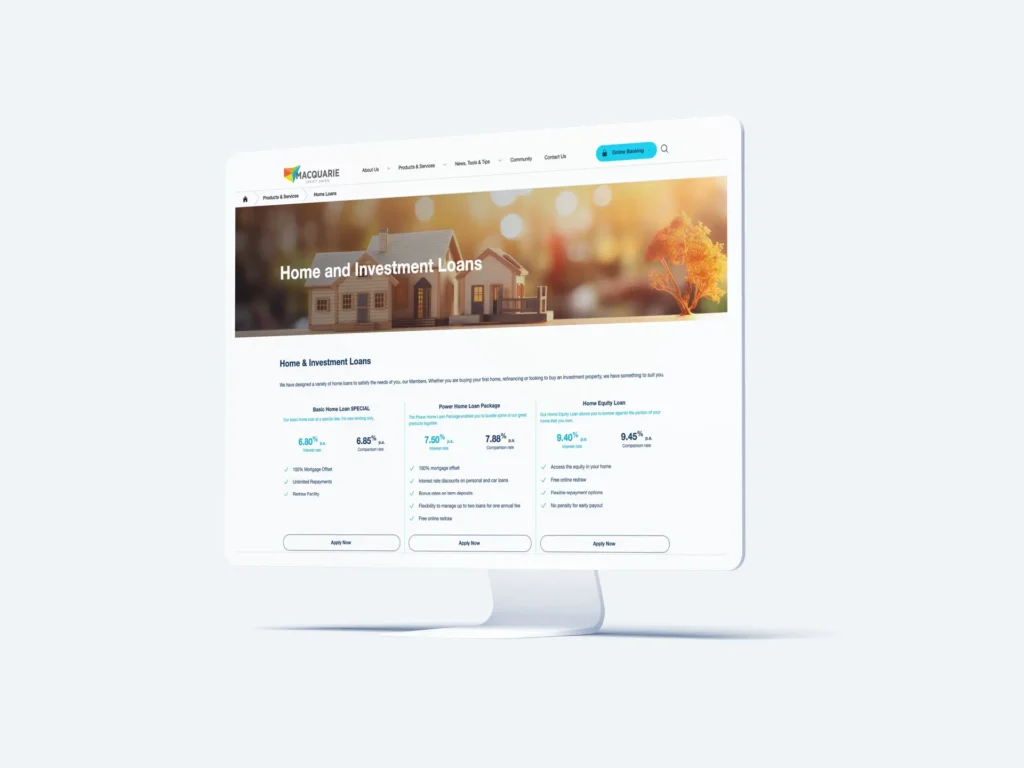

MCU’s existing website faced obsolescence, with an end-of-life deadline only months away. The challenge was not only to modernise the website but to align it with the evolving brand guidelines and prepare for potential branding changes associated with an upcoming merger with Regional Australia Bank (RAB). The goal was to attract new members, enhance the user experience for existing members, and streamline internal processes. With a strong focus on community values, MCU sought a website that not only reflected their mission but also provided a seamless experience for members and their internal team.

“Our website was outdated and no longer fit for purpose. Plus it wasn’t delivering on new customer acquisition. How do you make people want to come to your website and then how do you make them stay long enough for them to jump on board and become a member? These were questions we wanted to find answers to through the new website. SEO is a big issue in the Mutual space, but most providers don’t offer SEO support so it just doesn’t get looked at. Websites can be so boring. I wanted something that was refreshing and personable.”

Claire Bice, Head of Digital Transformation

The lack of visibility in Google search, outdated information architecture, and a manual, time-consuming process for website updates posed additional challenges. MCU’s team was eager for a fresh, appealing website that aligned with their evolving brand and accommodated their diverse member base, including older members requiring accessibility features.

Initially starting discussions in May 2023, MCU explored various options, ultimately opting to work with Sitback in June. However, unforeseen circumstances forced a project delay. In September, Claire reached out again, revealing MCU’s imminent merger with RAB. This led to a strategic re-evaluation of the project, considering the potential changes in branding and the urgency imposed by the impending merger. MCU needed a robust plan that aligned with their merger considerations, and Sitback became an essential partner in this strategic phase.

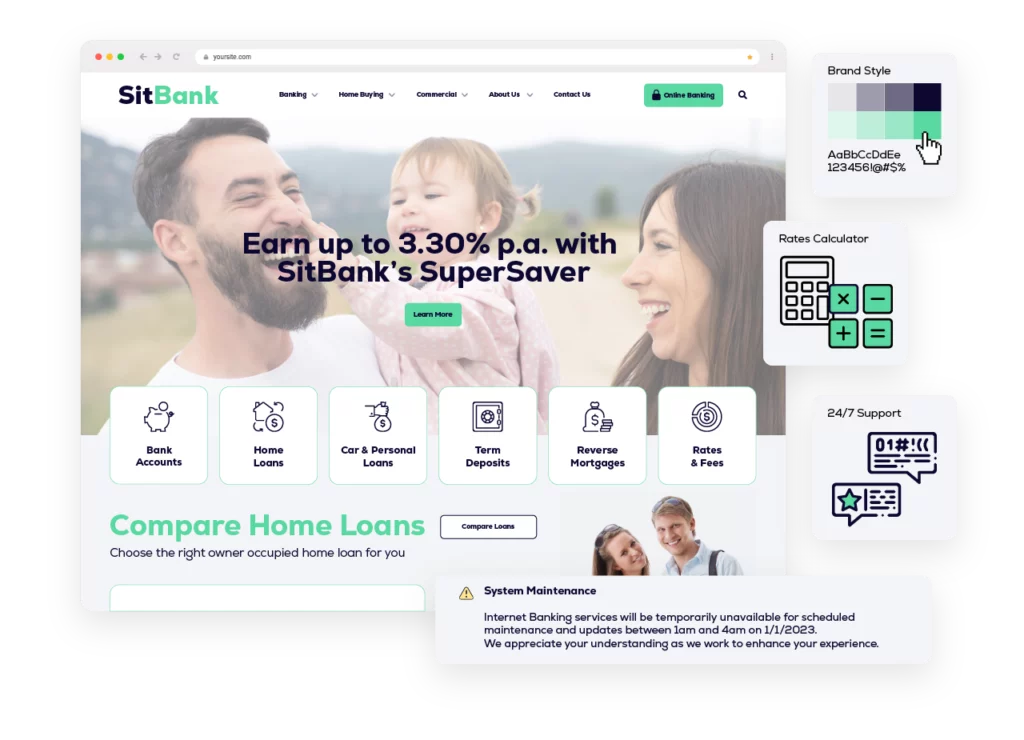

A fast, budget friendly solution

Facing uncertainties related to the merger, MCU found a robust solution in Sitback’s Accelerator Platform, designed to meet the unique needs of credit unions, mutuals, and member-owned banks.

“Cost and time to implement were massive concerns for us. With the Accelerator Platform, Sitback addressed both. The platform is incredibly budget-friendly, and I’m still amazed by how quickly everything came together!”

Claire Bice, Head of Digital Transformation

The platform provided MCU with a range of sector-specific features and functionality, including:

Seamless integration

MCU effortlessly integrated calculators provided by GBST into the Accelerator Platform, enhancing user experience and financial calculations.

Centralised rates management

The platform enabled MCU to manage rates across all products in a centralised backend, seamlessly integrating with the “What-you-see-is-what-you-get” (WYSIWYG) rich text editor for efficient content updates.

Responsive design and accessibility

The Accelerator Platform ensured a mobile-first, responsive design, complying with accessibility standards (WCAG 2.1 AA).

Hosting environment customisation

A dedicated Azure hosting environment, hardened and tailored to MCU’s security requirements.

MCU also benefit from ongoing Support & Optimisation services provided by Sitback, ensuring the website remains secure, up-to-date and receives new features as they become available.

Digital transformation

The Accelerator Platform enabled MCU to create a new website – from planning to development completion – within just two months, exceeding expectations and positioning the launch date a month ahead of schedule. The emphasis on user experience, seamless integration, and compliance, contributed to a swift and successful digital transformation.

A strong partnership developed between MCU and Sitback, built on trust, effective collaboration, and the ability to make quick decisions. This became a crucial element in risk mitigation, ensuring fast benefits for MCU’s customers during the transitional phase and demonstrating an effective synergy between strategic decision-making and technological innovation.

The Accelerator Platform offered a low-risk SaaS-style solution with a flexible subscription model, aligning with MCU’s budgeting needs. The robust content management system facilitates efficient content editing, ensuring a dynamic and engaging customer experience, and the centralised rates management feature makes real-time updates to rates across the website quick and easy, saving significant manual effort and ensuring consistency.

Conclusion

Macquarie Credit Union’s collaboration with Sitback and the adoption of the Accelerator Platform have not only revitalised their digital presence but strategically positioned them for the merger. The emphasis on trust, risk mitigation, and the accelerated project timeline showcases the successful outcomes achieved through collaborative decision-making and innovative technology solutions.

“We now have a functioning website that is easy to use. Not just from a member point of view, but for our staff who are using it day in and day out. Working with Sitback really has been the G.O.A.T!”

Claire Bice, Head of Digital Transformation