Enabling digital transformation: Member experience service design for leading credit union

Overview

People’s Choice is one of Australia’s largest credit unions with more than 365,000 members across Australia and branches and advice centres in South Australia, Victoria, the Northern Territory, Western Australia, and the Australian Capital Territory. They have more than $10.5 billion of funds under management and advice, and they offer a genuine alternative to the major banks.

People’s Choice Credit Union was embarking upon a transformation program to align their various customer-facing touchpoints, internal operations, and products with their strategic vision. Specifically, People’s Choice aimed to define their services, touchpoints and operations in a member-centric manner to ensure members enjoy an optimal experience, thereby increasing member engagement and the conversion of new members to People’s Choice.

To achieve this objective, Sitback conducted an extensive research phase and immersed ourselves in People’s Choice to better understand the business and help identify a roadmap of activities the Member Experience Team will conduct to support the rest of the organisation during this transformation.

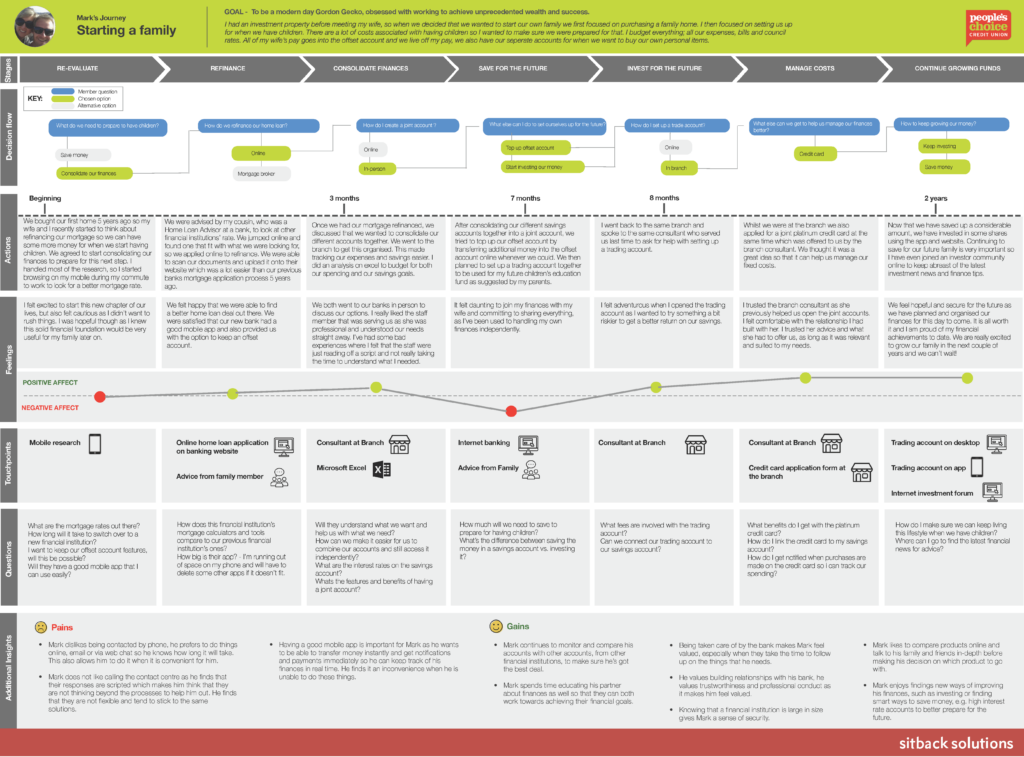

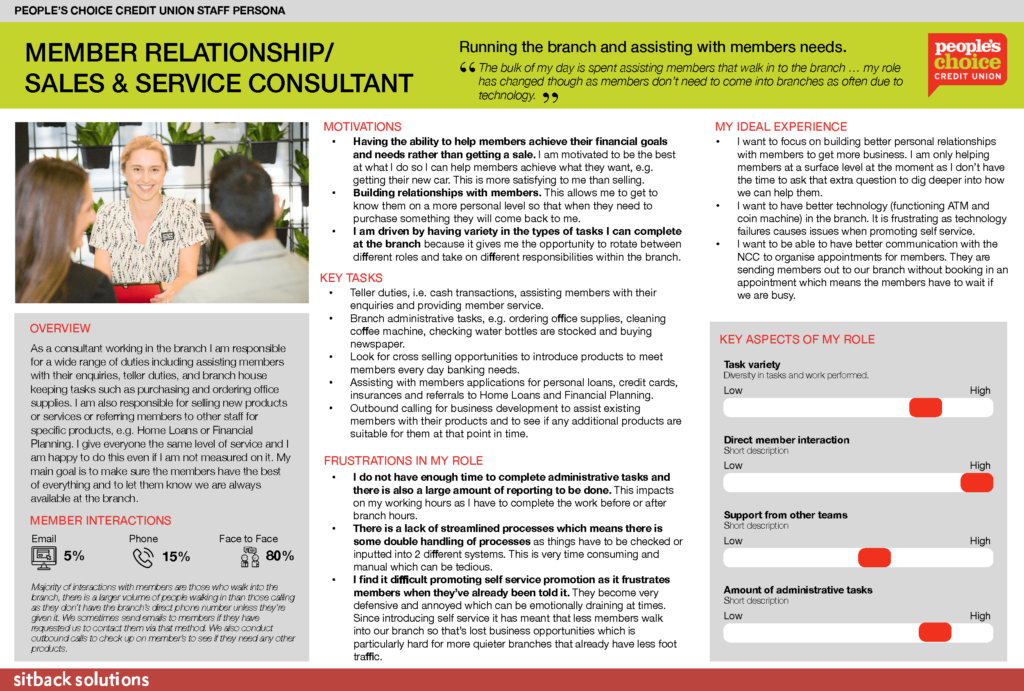

For the second phase of the project, we assisted People’s Choice’s Member Experience team in creating the design artefacts that we outlined in this roadmap. At the end of this phase, we had created member journeys, service blueprints and staff personas which we consolidated into member experience maps. These maps helped the organisation understand how both members and staff interact as the members go through different financial journeys at various life stages.

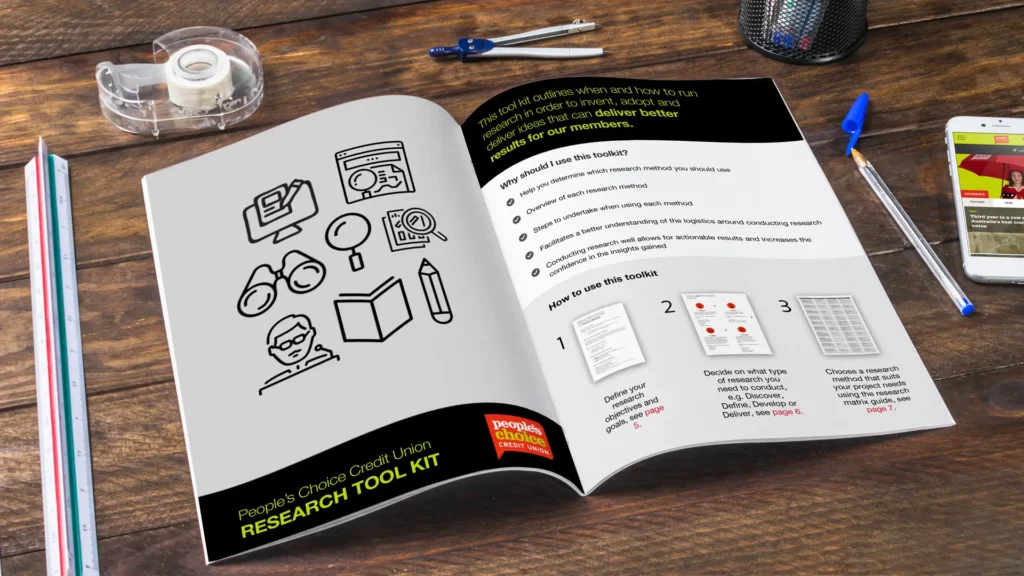

During the second phase, we also provided training and upskilling to their internal teams on UX capability and created a research matrix and research toolkit guide for the whole organisation to use.

Our approach

Phase 1: Immersion in the business

People’s Choice approached us to design several online functionalities, to streamline their web presence and promote self-service.

As such, we proposed to first conduct an Immersion phase to understand their business and the transformation program they were engaging in, to provide our best practice recommendations for what activities the Member Experience team should focus on for the next 18 months.

We started the project with a documentation review to understand the business procedures and processes. Then, we conducted several stakeholder interviews and stakeholder workshops to explore the business drivers, KPIs, and requirements that each of the departments had.

In the first workshop, we were able to determine the deadlines and dependencies each of the different department’s programs of work had on the Member Experience team. The various departments involved in these sessions included Marketing, Digital Banking, Retail and Digital Sales Delivery, Lending, as well as IT and Products.

After this session, we took the findings back to our internal team with UX, Development and Project Management to perform a gap analysis between the current state and the desired future state.

In the gap analysis, we outlined the current state and desired future state, the priority of achieving various future state goals from a member and business perspective, and identified the bridging activities required to achieve the future state. Additionally, we identified available resources and required resources, as well as the areas of development required and associated pace.

Following the gap analysis, we conducted another stakeholder workshop with the Head of Marketing and Head of Member Experience. During this session, we prioritised activities outlined in the gap analysis that needed to be completed to support the other departments’ projects for the transformation. The purpose of this workshop was to identify which activities were most important and urgent and the resourcing required to complete them.

From this workshop, we created a roadmap of planned initiatives for the Member Experience and Marketing teams including the priority, pace, and speed required to complete these initiatives.

Phase 2: Understanding the members

In Phase 2, we assisted the Member Experience team in completing several key initiatives as outlined in the roadmap. One of the first activities the address was the member journeys. We first conducted a documentation review of existing personas and journeys. We then ran a stakeholder workshop to identify the top decision points and member journeys to be mapped in detail.

Following that, we conducted 9 user workshops to gather user research for the member journeys. Based on the research data gathered, we created 9 member journeys in total for 9 different key life stages to understand the financial journeys members experience at each of these stages:

- Starting out in life

- First job

- Engaged

- First home

- Starting a family

- Living & renting out of home from a setback

- Planning for retirement

- Retired

We also created a member journey template for the Member Experience team to use.

For the next set of activities outlined in the roadmap, we helped the Member Experience team create staff personas and service blueprints. We first conducted a documentation review of existing staff personas and research the Member Experience team had previously conducted on staff.

We then validated the existing research by conducting 16 staff interviews. We ran two staff workshops to gather information about the front-stage and back-stage staff actions for the service blueprints.

Working in collaboration with the Member Experience team, another key activity we assisted in was creating the research technique toolkit and research methods matrix to be used for different use cases within the organisation.

We conducted a stakeholder workshop with the Member Experience team to identify requirements for the toolkit and matrix. In the toolkit, we provided detailed guidelines on how to conduct research, including:

- when to use a particular research method

- variants on a research method

- how to conduct the research

- analysis of the data

- other things to consider when running the research activity.

In the matrix we highlighted the different methods at a high level, the variants, purpose and type of data collected, to allow the reader to quickly determine which research method would be best suited for their needs.

Results and outcome

The Member Experience team has been empowered with the tools and knowledge needed to support the rest of the organisation in their digital transformation. After completion of this project, Sitback was also invited to conduct an additional 4 projects with People’s Choice: Digital Banking, Senior Leadership team UX training, a CRM rebuild, and website re-design.

Read more about how we leveraged Sitecore to create a new member-centric website banking experience for People’s Choice customers.