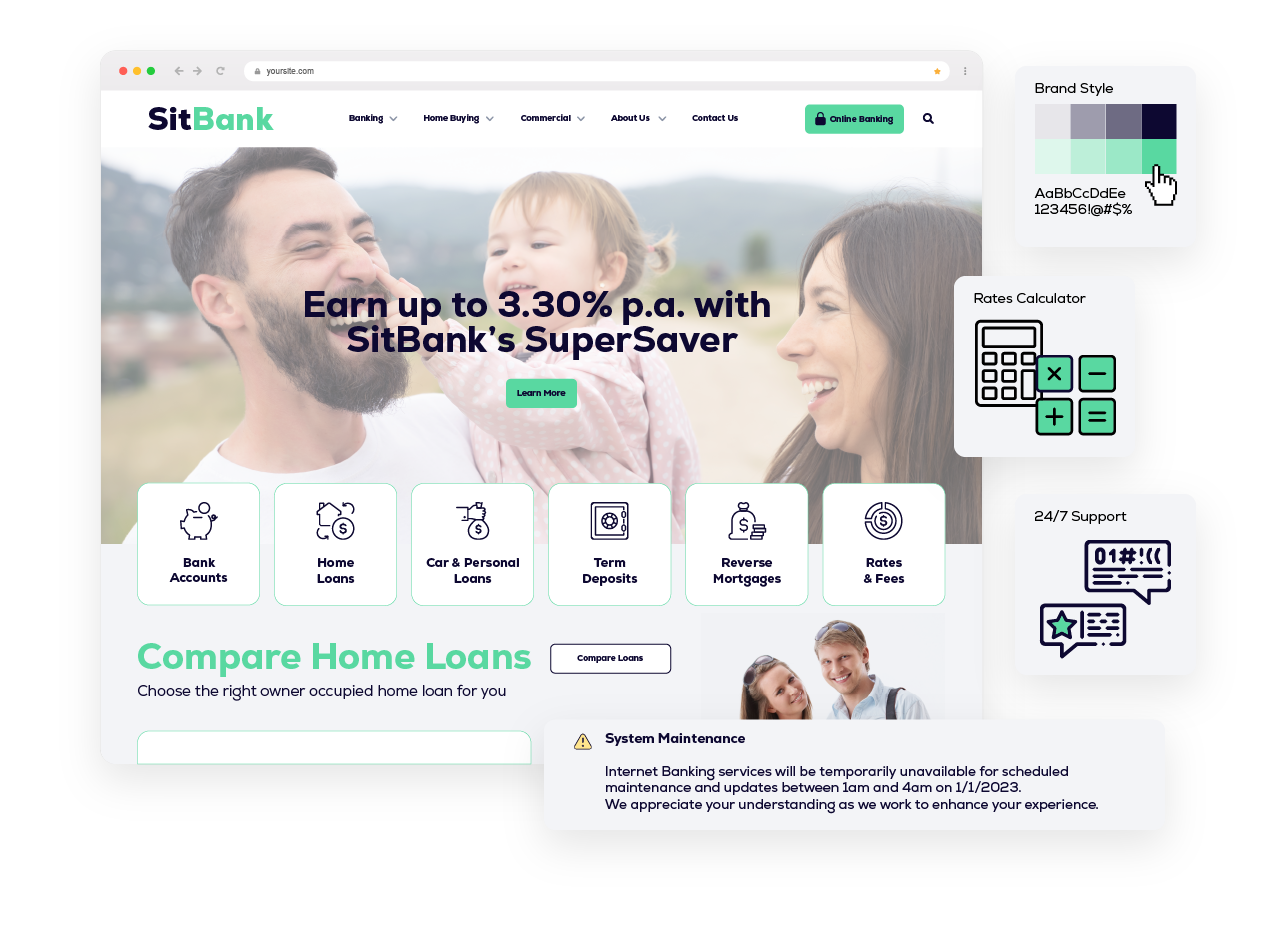

Making banking websites better for everyone.

Gain the market advantage with an optimised SaaS-style website solution

designed specifically for banks, credit unions and mutuals,

to drive new customer acquisition and elevate the member experience.

Your bank, your way

Sitback’s banking website accelerator platform is empowering growing credit unions, mutuals, and member owned banks through extensive features designed exclusively for marketing, brand, and communications teams in the finance industry.

Drive new customer acquisition and support existing members with the marketing tools and technology integrations you need to get your products in front of customers, no matter where they are or what device they’re on.

Discover why forward-thinking Australian banks choose Sitback’s platform to build their brand

Powered by the latest technology, fine-tuned for finance

Client success stories

Read about some of the great things our clients are achieving with our Accelerator Platform and Experience Design services.

Get started today

Start designing your perfect banking website today!

Simply tell us a little bit about your requirements and we’ll send through a no-strings attached information pack, including pricing options.

Core website features to keep you moving quickly

Powerful content management

Customise and extend to your needs

Optimised for banks, mutuals and credit unions